The Ultimate Guide to Discovering the Ideal Hard Money Lenders

From assessing lending institutions' track records to contrasting rate of interest rates and costs, each step plays a critical role in securing the finest terms possible. As you think about these elements, it becomes evident that the course to identifying the right tough cash loan provider is not as uncomplicated as it might seem.

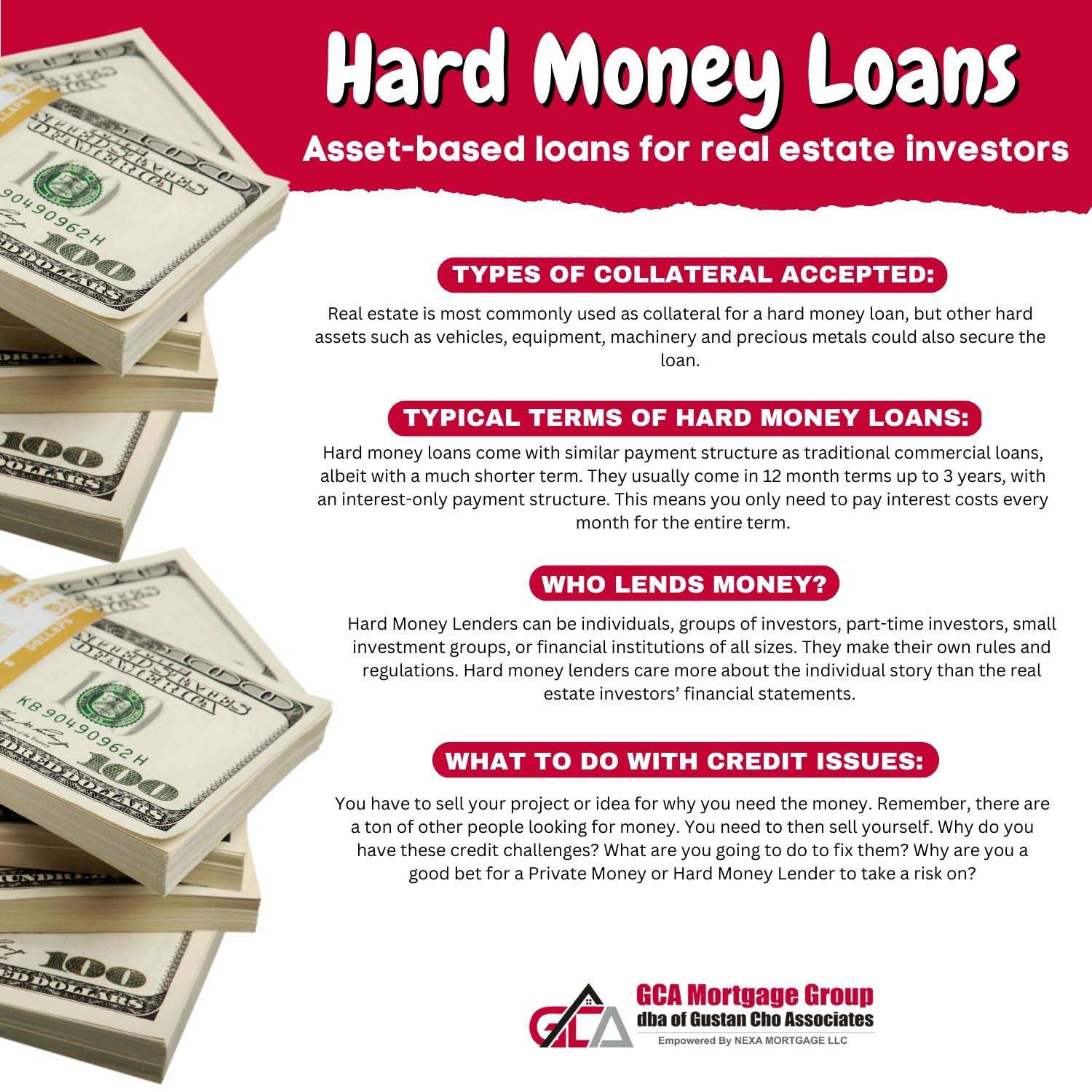

Recognizing Tough Cash Finances

Among the defining features of tough cash fundings is their reliance on the worth of the property as opposed to the borrower's creditworthiness. This permits debtors with less-than-perfect credit rating or those looking for expedited financing to accessibility funding a lot more conveniently. Additionally, hard cash lendings typically include higher rates of interest and shorter settlement terms contrasted to traditional car loans, mirroring the increased danger taken by lenders.

These lendings serve numerous functions, including funding fix-and-flip tasks, re-financing distressed buildings, or supplying funding for time-sensitive opportunities. Understanding the subtleties of tough cash financings is essential for investors who aim to utilize these financial instruments properly in their genuine estate endeavors (ga hard money lenders).

Trick Elements to Think About

Different lenders use differing passion rates, fees, and payment schedules. Furthermore, take a look at the loan provider's financing rate; a speedy approval process can be essential in affordable markets.

An additional important aspect is the lender's experience in your particular market. A lender accustomed to local problems can supply beneficial understandings and could be much more adaptable in their underwriting process.

Exactly How to Examine Lenders

Assessing tough cash lending institutions includes a methodical strategy to ensure you pick a companion that lines up with your investment objectives. Begin by evaluating the lender's online reputation within the market. Search for evaluations, reviews, and any kind of offered rankings from previous clients. A trusted lender should have a background of effective deals and a strong network of satisfied borrowers.

Next, examine the lending institution's experience and specialization. Different lenders may focus on different sorts of residential or commercial properties, such as household, industrial, or fix-and-flip tasks. Select a lending institution whose proficiency matches your financial investment method, as this expertise can dramatically affect the authorization process and terms.

One more crucial aspect is the lender's responsiveness and interaction design. A reliable lending institution needs to be accessible and eager to answer your inquiries thoroughly. Clear communication throughout the evaluation process can suggest how they will manage your lending throughout its period.

Lastly, make certain that the loan provider is transparent concerning their procedures and demands. This consists of a clear understanding of the documentation required, timelines, and any conditions that might use. Taking the time to assess these elements will encourage you to make an informed choice when selecting a difficult cash lending institution.

Comparing Rate Of Interest and Costs

A comprehensive comparison of rate of interest and costs among difficult money loan providers is crucial for optimizing your financial investment returns. Tough cash loans frequently feature higher interest prices compared to typical funding, commonly varying from 7% to 15%. Recognizing these rates will assist you evaluate the potential expenses related to your financial investment.

In addition to interest rates, it is essential to assess the associated fees, which can substantially impact the general financing expense. These fees may include origination costs, underwriting costs, and closing expenses, commonly shared as a percentage of the loan quantity. Source charges can differ from 1% to 3%, and some lenders may bill extra charges for handling or management tasks.

When contrasting loan providers, consider the complete cost of borrowing, which incorporates both the rates of interest and charges. This holistic approach will allow you to determine one of the most economical options. Be sure to ask about any feasible prepayment charges, go to this web-site as these can impact your ability to pay off the funding early without incurring added charges. Ultimately, a cautious analysis of rates of interest and charges go will cause even more educated loaning choices.

Tips for Effective Borrowing

Recognizing rate of interest prices and costs is just component of the formula for protecting a hard money funding. ga hard money lenders. To guarantee effective loaning, it is essential to thoroughly evaluate your financial circumstance and task the potential roi. Start by clearly defining your loaning objective; lending institutions are more probable to respond positively when they recognize the designated use the funds.

Following, prepare a comprehensive company plan that outlines your task, anticipated timelines, and financial estimates. This shows to lenders that you have a well-thought-out technique, improving your reputation. Additionally, keeping a solid connection with your lender can be valuable; open interaction cultivates trust fund and can result in a lot more desirable terms.

It is likewise vital to make sure that your residential property fulfills the loan provider's requirements. Conduct an extensive appraisal and offer all needed paperwork to streamline the approval process. Be conscious of exit methods to settle the finance, as a clear repayment plan reassures lending institutions of your dedication.

Final Thought

In summary, situating the very best tough cash lenders requires a thorough evaluation of numerous components, including lending institution credibility, loan terms, and specialization in home kinds. Effective assessment of loan providers via comparisons of passion rates and costs, integrated with a clear service strategy and strong interaction, boosts the chance of desirable borrowing experiences. Eventually, attentive study and strategic involvement with lending institutions can result in successful economic outcomes in property endeavors.

Furthermore, difficult money a knockout post car loans typically come with greater interest prices and much shorter settlement terms contrasted to standard finances, mirroring the boosted risk taken by lenders.